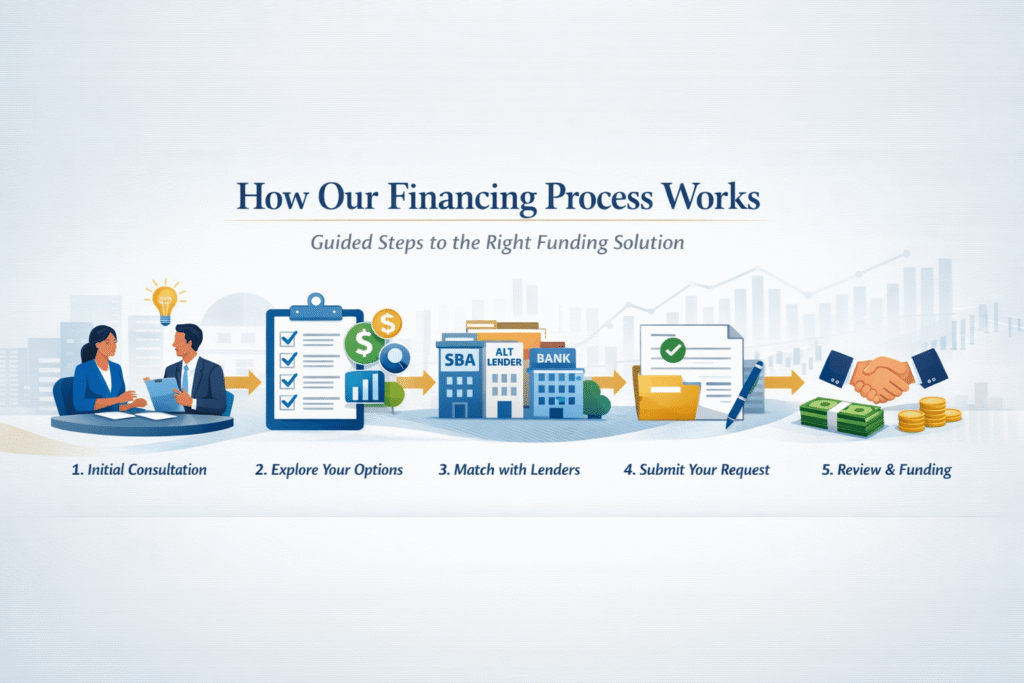

A Clear, Practical Path to Business Financing

Securing business funding doesn’t have to be confusing, time-consuming, or discouraging.

At Trust Financing Solutions (TFS), we guide you through the process step by step — helping you understand your options, avoid wasted applications, and pursue funding paths that actually fit your situation.

Step 1: Start With a Conversation

Every business is different. Before lenders, paperwork, or applications, we start by understanding your goals and constraints.

We discuss:

-

What you’re trying to accomplish

-

How much capital you need

-

How quickly you need it

-

Your business stage and experience

-

Any prior bank declines

This ensures we don’t send you down the wrong path.

👉 For many clients, this begins with our Get Pre-Qualified form.

Step 2: Evaluate Your Financing Options

Once we understand your situation, we assess which types of financing may be realistic — and which are not worth pursuing right now.

We look at factors such as:

-

Time in business

-

Revenue and cash flow

-

Personal and business credit profile

-

Use of funds

-

Industry considerations

Our goal is clarity — not false hope.

Step 3: Match You With the Right Funding Sources

TFS is not a lender. We work with a broad network of non-bank, alternative, SBA, and institutional lenders, each with different criteria and risk appetites.

Instead of applying everywhere, we:

-

Identify lenders that fit your profile

-

Align your request with lender expectations

-

Reduce unnecessary credit pulls

-

Save time and frustration

This targeted approach improves outcomes and protects your credit.

Step 4: Package & Position Your Request

How a financing request is presented matters.

We help ensure your request is:

-

Clearly explained

-

Properly documented

-

Aligned with lender underwriting standards

This may include guidance on:

-

Financial summaries

-

Use-of-funds narratives

-

Basic readiness preparation

We focus on positioning — not over-promising.

Step 5: Review, Decisions & Next Steps

Lenders make all credit and approval decisions independently.

As responses come in, we help you:

-

Understand offers and terms

-

Compare realistic options

-

Decide whether to proceed, adjust, or wait

If no viable options exist at the moment, we’ll explain why — and what can be done to improve your position over time.

What Makes This Different

Traditional lending often feels like a black box.

Our process is:

✔ Transparent

✔ Educational

✔ Strategic

✔ Aligned with real-world lending criteria

We believe informed borrowers make better decisions.

What This Process Is — and Is Not

This process IS:

-

Advisory and educational

-

Focused on fit and feasibility

-

Designed to save time and protect credit

This process IS NOT:

-

A guarantee of financing

-

A loan application

-

A one-size-fits-all solution

Who This Process Works Best For

-

Business owners seeking working capital

-

Buyers acquiring an existing business

-

Companies turned down by banks

-

Owners needing flexibility and speed

-

Borrowers who want clarity before applying

Ready to Get Started?

The first step is simple.

👉 Get Pre-Qualified

👉 Schedule a Free Strategy Call