Merchant Cash Advances (MCAs) present a unique option for businesses in need of quick capital. Unlike traditional loans, MCAs offer a lump sum payment in exchange for a percentage of future sales. It is easy to get an MCA, but the costs can be quite high and devastating to borrowers.

Trust Financing offers alternatives to MCA debt.

This article explores the intricacies of MCAs, weighing their benefits against potential risks, and provides guidance on how to use them effectively.

1. How Merchant Cash Advances Work

A Merchant Cash Advance provides businesses with immediate capital by purchasing a portion of their future credit card or debit sales. The repayment is not a fixed monthly amount but is instead based on a percentage of daily sales volumes. This method ensures that payments adjust according to the business’s incoming revenue, providing flexibility during varying sales cycles. For example, a retail store might agree to pay 10% of its daily credit card revenue until the advance is paid in full, reflecting the store’s financial inflows and outflows.

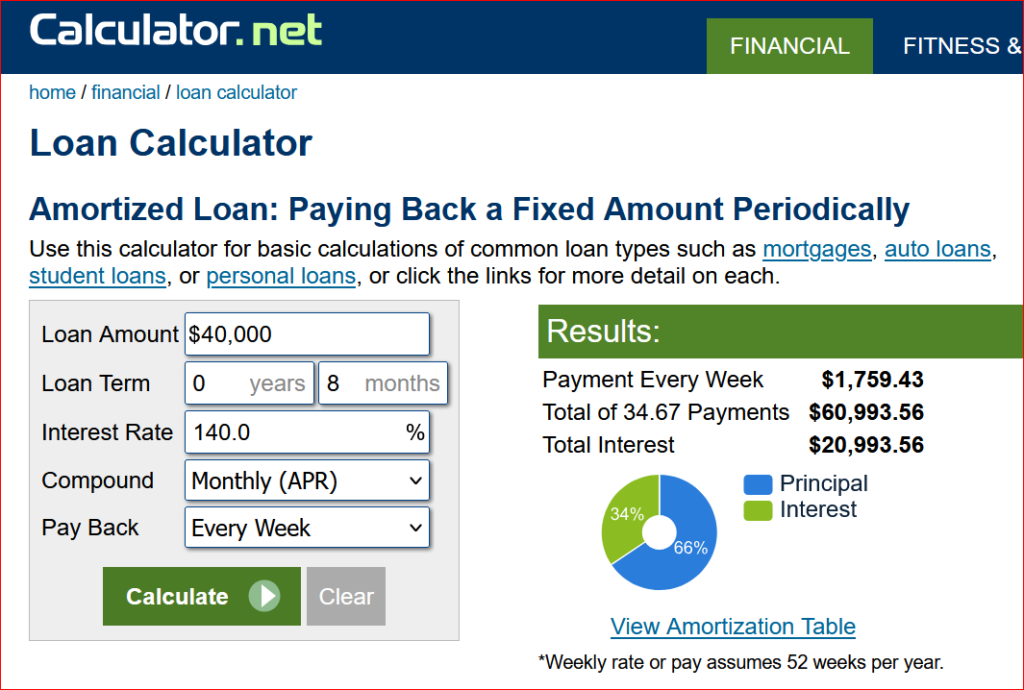

The implied interest rate can be quite high on an MCA loan. That implied rate could be around 150%. Those high costs can strip a company of all profitability, and MCA debt can kill a company. There are better alternatives. Contact Trust Financing Solutions before you might need an MCA loan — let’s get a better financing facility in place.

2. Advantages of Merchant Cash Advances

Quick Access to Funds: One of the most significant advantages of MCAs is the speed of funding. Businesses can access funds within days of approval, which is considerably faster than traditional bank loans that may take weeks or months to process.

No Collateral Required: Unlike secured loans, MCAs do not require collateral. This lack of collateral can be advantageous for businesses that lack physical assets to pledge or prefer not to risk their assets.

Flexible Payments: Since repayment terms are based on sales, businesses benefit from more manageable payments during periods of lower revenue, thus avoiding the financial strain that fixed monthly payments can cause during slow business periods.

3. The Cost of Using Merchant Cash Advances

Factor Rates vs. Interest Rates: MCAs use factor rates to determine the cost of the advance, typically ranging from 1.1 to 1.5 times the advanced amount. Unlike traditional interest rates, factor rates are calculated upfront and do not compound over time, but this can still make MCAs more costly than other financing options.

Higher Costs than Traditional Loans: Due to their unsecured nature and the higher risk taken by lenders, MCAs often come with higher costs compared to traditional loans. This aspect should be carefully considered, especially for businesses that may have other, less expensive financing options available. Explore all other options before taking an MCA loan.

4. Risks and Considerations

Debt Cycle Risk: Frequent use of MCAs can lead to a cycle of debt, especially if a business takes out additional advances to pay off previous ones. This cycle can be detrimental to long-term financial stability. Contact us when you need help to restructure an MCA. We can help with Debt Restructuring.

Impact on Cash Flow: The automatic deduction of sales revenue can significantly and negatively impact cash flow, especially if the agreed-upon percentage is too high. Businesses must ensure they can maintain operational expenses and profitability with these deductions.

5. Best Practices for Using Merchant Cash Advances

Assessment of Financial Health: Businesses should thoroughly assess their financial stability and predictability of revenue streams before opting for an MCA. This financial product is best suited for businesses with high credit card sales and short-term capital needs.

Comparison with Other Financing Options: It’s advisable to compare MCAs with other financing options. Sometimes, alternatives like Lines of Credit(LOC) or Term Loans offer more favorable terms.

Strategic Use for Short-term Needs: Ideally, MCAs should be used for short-term financial needs or to take advantage of immediate business opportunities, such as buying inventory at a discount. But the costs can be very high to the borrower. Be careful!

Conclusion

While MCAs can provide quick access to funds and flexible repayment terms, they come at a high cost and with high risks that must not be overlooked.

Businesses considering this financing option should thoroughly understand the terms and calculate the impact on their financial operations.

Make sure you understand the implied interest rate that is being charged. That rate can be very high with an MCA. You can use a loan calculator to get a sense of that implied interest rate.

Here is an example of an MCA implied interest rate using the loan calculator:

Many states, such as Virginia and others, now require that interest rate to be disclosed clearly in the loan agreement.

Call to Action

Consulting with a financial advisor or a lender specialist can provide valuable insights and help you determine whether a Merchant Cash Advance is suitable for your business needs.

Make an informed decision to ensure that this expensive financial product benefits your business without compromising its future growth. MCA debt can ruin a company. Be careful and be sure you understand the costs.

Trust Financing Solutions offers many alternatives to an MCA loan. Contact us about your financing needs and let’s find the better solution for you.