Our loans are processed more quickly and efficiently than many others. We are a Preferred Financial Services company as designated by our SBA lenders.

The Trust Financing team is expert at placing SBA loans. We enjoy these projects and getting them funded quickly. Here are two SBA loans for smaller dollar amounts:

SBA Micro Loan: $15,000 – $50,000

SBA Express Loans: $100,000 – $350,000

.

For the larger dollar amounts, we have:

SBA 7a Loans: $350,000 – $5,000,000 and up to $7.5 million with pari passu.

SBA 504 Loans: We have 504 loans up to $12 million.

USDA B&I Loans: Up to $25mm with negotiated terms.

.

Contact us now to get your SBA funding!

There are a number of advantages to an SBA loan, including longer terms, no points and a low down payment.

SBA Loan Program

| Loan program | Max. Loan Amount | Terms & Interest Rates | Purpose |

| SBA 7(a) Loan | $5.0 million | Up to 25 year term. Fixed: Prime + * Variable rates are available too |

General business financing |

| SBA 504 Loan | $5.5 million | Up to 25 year term. | Financing major fixed assets such as equipment and real estate |

| SBA Express Loan | $350,000 | Up to 25 year term. | Fast turnaround (36 hours) |

| SBA Micro Loan | $50,000 | Up to 7 year term. | Great for every business requiring smaller loan amounts. Funds quickly. |

| USDA B&I Loan |

$25,000,000 | Up to 40 year term.

. |

|

* Based on the prime rate. Varies over time.

Who is Eligible for an SBA Loan?

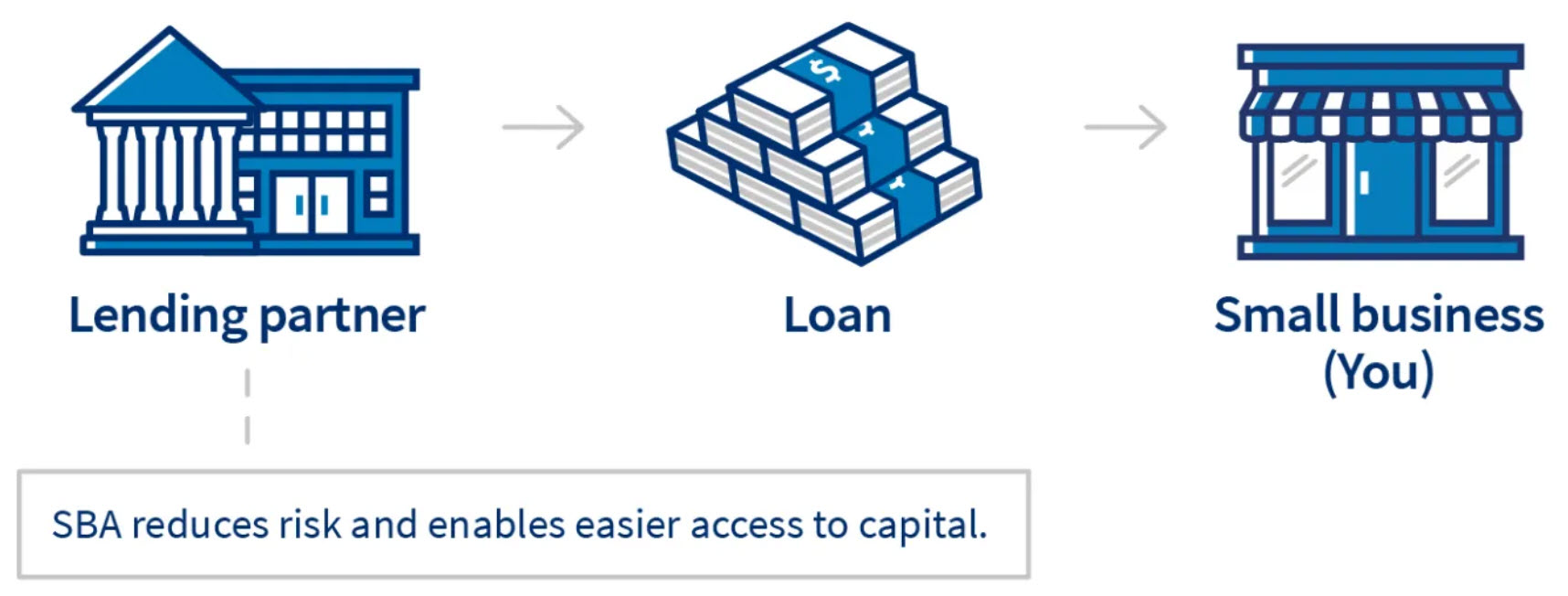

Most for-profit small businesses are eligible for an SBA guaranteed loan. This includes manufacturers, wholesale, retail and service businesses as well as independent or franchise businesses.

SBA 7(a) loan program

The SBA 7(a) loan program is the SBA’s primary product for general financing. The standard 7(a) loan is the most popular SBA program available today with favorable rates and terms. More than 40,000 SBA 7(a) loans were made in fiscal year 2020 at a total over $22 billion.

Uses

- Purchase land or buildings

- Buy a Business

- Purchase and install fixed assets

- Construct new buildings

- Purchase inventory and supplies

- Working capital

- Refinance some outstanding debts

Loan amounts

The maximum loan amount for the 7(a) loan is $5 million.

SBA 504 loan program

The SBA 504/CDC loan program partners with Certified Development Companies (CDCs) to provide long-term financing to purchase major fixed assets. A 504/CDC loan provides up to 50% funding from a commercial lender and up to 40% funding from the CDC office in your area. The borrower will have to provide at least 10% as equity.

Uses

- Purchase machinery and equipment

- Purchase land or building

- Construct, remodel or improve a building

- Purchase or install fixtures

Loan amounts

The range of the CDC portion in a single project is $5 million, increasing to $5.5 million for some manufacturers and energy-related projects.

Other SBA Loans

The SBA program that’s right for your company will depend on the amount you are seeking as well as the purpose of the loan.

Micro Loans

The SBA Micro Loan program provides loans up to $50,000 to meet many business needs. Funds quickly.

Uses

- Working capital

- Machinery or equipment

- Inventory and supplies

- Furniture

- Fixtures

Loan amounts

Micro Loan amounts can range up to $50,000.

SBIC – Small Business Investment Company

The SBIC program is an investment program that increases access to capital for growth stage businesses. Trust Financing works with select SBIC firms on deals or transactions that are larger than the limits of the SBA 7A or 504 programs.

SBIC small business financings are primarily in the form of subordinated debt with equity enhancements. SBIC financings to small businesses typically range from $2.5 million to $10 million. Each SBIC has its own investment profile in terms of targeted industry, geography, company maturity, and the type and size of financing the SBIC will provide to small businesses.

The Trust Financing Solutions team works with SBIC investors when needed to get the deal done.